Breakout Indicator MT4

Every trader wants to earn profits and would support whatever legitimate strategy or tool that is available to enable him to actualize his dream. There are two major ways a trader can trade in forex trading: Breaking Trading and Trend trading. Both share a common goal of making profits, though these trades are dependent on market behavior.

A breakout indicator is a trading tool used for finding key level strategies. This indicator seeks key support and resistance levels. There are many breakout strategies, but the most frequently used are London breakout indicator, support and resistance indicator, etc.

The concept is that when a definite zone is incapable of maintaining its price line, a new zone will be created. Hence, Breakout Strategy depends on conditions where the support and resistance zones are no longer effective in maintaining their zones.

Breakout trading will open a spot in the break line zone in a specific area. In this article you can discover if we add the breakout indicator MT4 to our list off Winning Metatrader Indicators.

Table of Contents

Install the Indicator

The Breakout indicator MT4 is quite a simple indicator. Although you will have to input the time for the indicator, you do not have to draw the breakout ranges manually. As the breakout boxes are automatically plotted for you.

The breakout indicator is generally set up to begin from the first hour of trading. Every trader can set the final hour of trading. During this time frame, the high and low of the period are plotted by the breakout indicator MT4.

Getting started, you need to install the indicator. Here is an easy step-way in installing the indicator.

- Download the Breakout Indicator MT4.

- Install it into the indicators folder of your MT4 trading platform.

- On opening your trading terminal, refresh the indicator window.

- Once the breakout indicator is seen in your list, drag and drop the indicator into the chart of your choice.

If you want to see everything in detail you can read our how to install indicators on MT4 article.

Using the Breakout Indicator MT4

There are several strategies that a trader can use with the breakout indicator MT4. Nevertheless, it is essential to note that the breakout indicator is best used when using the one-hour-chart time frame. Here are some of the roles breakout indicator MT4 plays:

1. London Breakout Indicator

The London session’s commencement is when a lot of the market’s volatility and price movements begin to increase and create more trading chances. London breakout strategy employs the surging movement in the London session. This is where the bulk of the trading is carried out every 24 hours in the period.

You don’t require using any indicators in running this London Breakout forex trading strategy. The London MT4 Breakout Indicator is a simple indicator that gives definite buy and sell signals based on which way the price is breaking along with prices that are suitable.

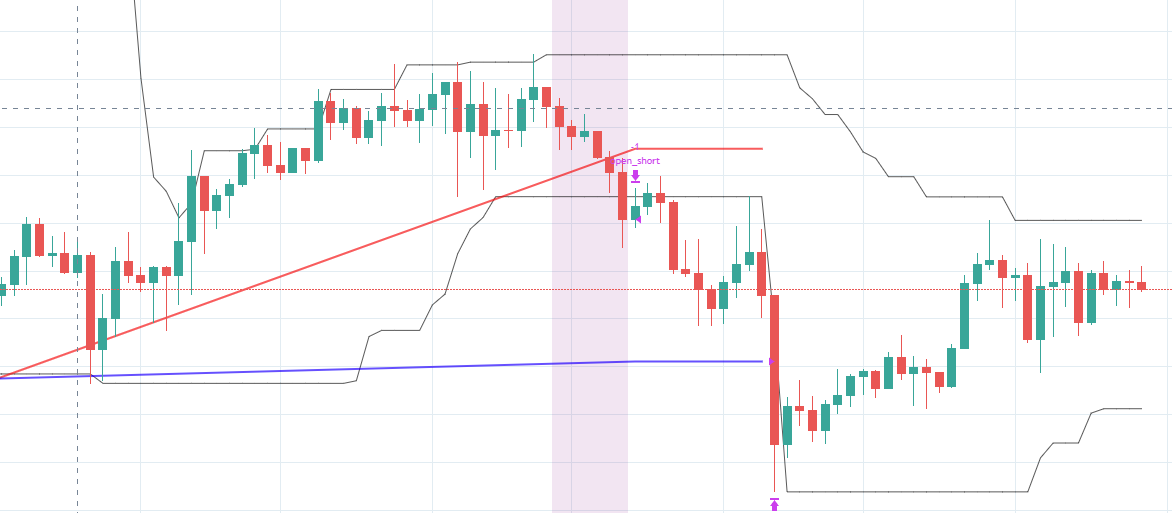

2. Support and Resistance Breakout Indicator

Support and resistance levels are the major levels for trading breakouts, aside swing highs and swing lows. Breakout support and resistance strategies employ key levels whenever the broken price line takes place at that level.

The breakout can frequently be massive and fast-paced if the support or resistance level has been established and is being valued over time. To lessen your trade time of detection, and avoid losing trade, use an efficient indicator. This will enable you to discover these levels and spot possible breakout zones.

To use this trading strategy, understand the concepts of support and resistance, and draw a chart further. Horizontal lines are used to spot the support and resistance levels. The concept is that whenever prices jump at the support and resistance levels, it marks a new level of support and resistance.

3. Breakout indicator strategy using MACD

MACD is one of the standard indicators used in measuring the volatility of the price. It makes use of a histogram template for analysis. When the histogram increases in size, it indicates a rise in price. A higher histogram implies that volatility is increasing (a surge in momentum), while a shorter histogram shows weakening volatility.

It is also used as a breakout strategy by traders. You will need to combine this with a fractal indicator to get support and resistance as a zone to determine entry breakouts (A Fractal indicator uses a curve or geometrical figure with the same statistical characters).

4. Relative Strength Index Indicator:

RSI Indicator is a highly suitable indicator for confirming reversal breakouts. Similar to MACD, RSI creates divergences; spotting helps forecast possible trend reversals. RSI enables traders to know how extensive a trend has been overbought or oversold. When the RSI value is above 70, it is interpreted as an overbought market, and if it is below 30, the market is oversold.

5. Breakout indicator strategy using ATR

ATR means Average True Range. It is used to measure and ascertain the stop-loss distance along with being used for the breakout strategy.

It works together with other indicators to make good use of momentum breakout in the indicator. Other indicators that can be added are EMA (Exponential Moving Average) with a period of 14 and resistance/support for finding high and low swings. Do not forget that the broker you are using is huge important. You can read our Libertex review here and discover why we love to use this broker.

Conclusion Breakout Indicator MT4

Breakout Indicators MT4 can be very rewarding and gainful once mastered. The trader needs to mainly focus on the critical zone before applying the breakout strategy, especially considering the trading session and the timeframe.

Since the breakout strategy is a strategy used by traders to seize the opportunities available in the forex market: finding support/resistance level and swing highs and swing lows, the Breakout indicator MT4 remains a help tool amid traders. London breakout, support and resistance breakout, MACD are examples of these breakout indicators.

Most time, significant breakouts happen when there is a price outbreak from an opening range, it can occur when price breaks out of the day-to-day high or low, or an hour chart high or low. Where the movement starts getting high, this strategy can deliver profits with high probability. And no trader would miss breakout trades of high quality.

If you want to inject further energy into your trading, then here are several other tools, which can easily leverage to improve your chances of making higher profits and limiting losses. Check about that via our best forex indicator website and take the step towards financial freedom.