OctaFX Review

Welcome to Our Best Forex Indicator Website. OctaFX Review is the subject of today’s post. In this analysis, we’ll go through the broker’s short overview, available accounts, assets/markets, trading channels, deposits/withdrawal processes, sponsored countries, educational tools, pros/cons, and final thoughts on the broker. So, if you’re interested in learning more about this broker, keep reading.

Let’s get started!

Table of Contents

What is OctaFX?

OctaFX is also the official sponsor of Southampton Football Club, which is great news for football supporters. For those who are not persuaded by a sports connection, you would be pleased to learn that it is approved and regulated to sell its financial services in many countries around the world. OctaFX is the brand name of Octa Markets Incorporated, which was established in 2011. OctaFX’s offices are in St Vincent and the Grenadines, and the organization meets all relevant laws and regulations.

OctaFX may be a newcomer, but it has already received several prestigious awards. The Global Banking and Finance Review as well as the Forex Journal Magazine have also given OctaFX high marks. In 2014, it was named both the Best ECN Broker in Asia and the Best Central Asian Broker.

OctaFX is an STP (straight-through processing) and ECN Forex broker (Electronic Communication Network). Tight spreads are allowed, order execution is fast, and there is no slippage or requotes. Both major currency pairs, as well as gold and silver, may be exchanged. MT4, MT5, and the recent cTrader are the trading platforms available. OctaFX Forex rewards provide a range of promotions, tournaments, and reward services in addition to a variety of discounts, tournaments, and incentive services.

OctaFX has a robust training center that contains a helpful page of FAQs, as well as maps, a glossary, and some useful Forex trading posts.

Let’s dive into details of the OctaFX Review!

OctaFX: Trading Platforms

The trading channels offered by OctaFX will be discussed in this part of the OctaFX Review. Traders can choose from two trading platforms offered by OctaFX. Both platforms can be found on a desktop, mobile, or portable computer. MT4 is the more well-known name, but cTrader, a more recent alternative, is also available.

MetaTrader 4 (MT4)

This user-friendly platform has become a favorite of many traders and dealers. Over the years that it has been available, it has proven to be very successful and capable for a large variety of traders. Price indices, charting software, advanced risk management, scripts, and real-time market execution are only a handful of the services and techniques available.

cTrader

While this technological approach is still relatively new, it has already proven to be profitable for several interested traders. It’s adaptable, and the style is fresh and modern. This alternative to MT4 has a few more bells and whistles, so it’s worth a shot, particularly because there’s a free trial account option.

MetaTrader 5 (MT5)

This multi-asset platform offers superior trading platforms as well as quantitative analysis. You may also use automated trading systems with MT5. It’s a full trading forum.

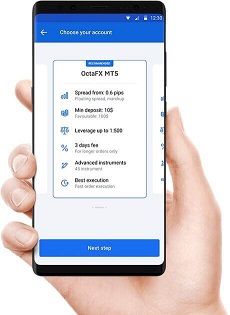

OctaFX: Trading Accounts and Fees

This section of the OctaFX Review will focus on the trading accounts and commissions that this broker provides. OctaFX offers a few options for trading accounts.

MetaTrader 4 Micro Account

The Micro Account needs just a $5 minimum deposit, making it suitable for beginners or those on a tight budget. For a total of 10 lots, the minimum order quantity is 0.01 lots. Leverage is available up to 1:500.

MetaTrader 5 Pro

This is the account to use if you’re an experienced dealer. Spreads start at 0.2 pips and are floating. There are 28 currency pairs, four cryptocurrencies, and several other tools accessible. Please bear in mind that the availability of cryptocurrencies is controlled.

CTrader ECN

Things differ slightly on a cTrader ECN account because it is a radical trader account, which means the pricing is more transparent. The leverage is 1:500 for currencies and 1:200 for metals. There are 28 currency pairs, as well as gold and silver, that can be traded.

Fees

Typical EUR/USD vector spreads are about 0.7 pips on both the MetaTrader and cTrader platforms. Spreads on gold (XAUUSD) start at around 2 pips and rise to around 3.5 points for major indices like the NAS100. Spreads on bitcoin are about 3.1 pips (BTCUSD). Set spreads are also available for MT4 USD accounts.

Trading costs are charged at 0.03 USD per 0.01 lot only in the cTrader portfolio. Rollover thresholds apply to openings that are left for more than three days. These fees are defined in detail in the product specifications.

OctaFX: Assets Available

The properties and markets provided by OctaFX to its traders will be revealed in this portion of our OctaFX review. OctaFX sells a wide range of assets, including the following:

- Forex – 28 currency pairs available, including EUR/USD and USD/JPY

- Indices – 10 CFD indices available, including US30 and NASDAQ

- Commodities, such as spot gold and silver, as well as Brent and crude oil

- Cryptocurrencies, which include Bitcoin, Ethereum, and Litecoin, three of the most common digital currencies.

OctaFX: Deposit and with drawl Methods

The deposit and withdrawal methods available when trading with OctaFX will be disclosed in this portion of the OctaFX Review. While OctaFX offers commission-free deposits and withdrawals, the choices are restricted to Neteller, Skrill, or Bitcoin, and are subject to minimum amounts.

OctaFX charges no commissions on deposits and withdrawals, and in some cases, the broker offers a 50 percent deposit bonus. The minimum deposit for both Neteller and Skrill is USD 50. Users will need to validate their accounts so withdrawals will have a minimum number of USD 5. This may be achieved by verifying their name and address.

Alternatives for the following countries are available:

- Banks, Visa, FasaPay, Bitcoin, and Help2Pay are all available in Indonesia.

- Local banks, Visa, Neteller, Skrill, Help2Pay, and Billplz are all available in Malaysia.

- Visa, Neteller, Skrill, Bitcoin, and Billplz are all available in Pakistan.

- Local banks, Neteller, Skrill, Bitcoin, Billplz in South Africa and Nigeria

OctaFX: Supported Countries

The countries from which OctaFX admits traders are highlighted in this section of the OctaFX Review. Traders from Germany, Thailand, Canada, South Africa, Singapore, Hong Kong, India, Pakistan, France, Norway, Sweden, Italy, Denmark, Saudi Arabia, Kuwait, Luxembourg, Qatar, the United Arab Emirates, and several other countries are welcome to join OctaFX.

OctaFX is not available to traders from the United States.

OctaFX: Customer’s Service

In this portion of our OctaFX Review, we’ll go over the customer service solutions open to you with this broker. Non-EU consumers can call the helpline, +44 20 3322 1059, Monday through Friday between 00:00 and 24:00 for telecommunications assistance (EET). The number to call for EU customers is +357 25 251 973 from 9:00 a.m. to 18:00, Monday through Friday (EET).

There is also an email option, but the best way to contact them is via the live chat service, which is available 24 hours a day, 7 days a week. The support team is helpful if you need to explain your withdrawal pin, have any platform issues, have VPS questions, or want to delete an account.

Additionally, the broker’s social media pages, as well as the OctaFX YouTube site, offer updates.

The broker’s website is available in several languages for clients from Indonesia, Malaysia, Pakistan, and India.

OctaFX: Education

The educational tools available when using OctaFX will be discussed in this portion of the OctaFX Review. OctaFX has a wide range of posts, videos, and guides for both experienced traders and beginners. There is a lot of information about how to use MetaTrader and cTrader trading systems and the advanced features of each platform when setting them up.

Pros and Cons

Pros

- A wide range of trading accounts for both novice and seasoned traders (Micro, ECN, Pro, Sharia)

- Access to Forex ECN with leverage of 1:500

- Trade on MT4, MT5, and cTrader through desktop, network, and smartphone

- Copy-trading access, reward deals, and a wide range of testing tools

Cons

- Limited commodity markets, no individual stock CFDs

- Few deposit and withdrawal options, only Neteller, Skrill, or Bitcoin

- No USA Clients

Conclusion OctaFX Review

This brings us to the conclusion of our OctaFX Review. OctaFX offers a wide range of trading accounts, including the MT4 Micro Account, MT5 Pro Account, and cTrader ECN Account. The broker also offers a free trial trading account, a subscription to the OctaFX Copy Trading App, and a variety of trading research tools and instructional materials.

Both of these accounts have unique benefits and incentives for both new and seasoned traders, such as commission-free trading on the MT4 Micro and MT5 Pro accounts and no spread mark-ups on the cTrader ECN account.

OctaFX traders can transact in a range of asset classes, including Forex, Indices, Metals, Energies, and Cryptocurrencies, but the trading resources available vary by account. Users will trade on the globally recognized MetaTrader 4, MetaTrader 5, and cTrader trading sites as well as enjoy various bonuses and exclusive offers through their Windows Desktop, Internet, and Mobile Trading App. So, if you want to get your hands on it, don’t hesitate to test it out in a DEMO account first to see how it works for you!